Effortless, Fractional Investment In Oil & Gas Properties.

Explore

Expected and unexpected additional cash flow can manifest from mineral interests in many ways, including:

- Lease bonuses associated with presently unleased acreage owned by the tokenized entity.

- The drilling of additional wells on entity-owned acreage in the future, increasing cash flow.

- Increases in oil & natural gas prices over time, which themselves act as a hedge against inflation.

- Improvements in drilling and extraction technologies over time which can result in increased production from existing wells, better production rates from new wells drilled in the future, and viability of new drilling locations.

Expected and unexpected additional cash flow can manifest from mineral interests in many ways, including:

- Lease bonuses associated with presently unleased acreage owned by the tokenized entity.

- The drilling of additional wells on entity-owned acreage in the future, increasing cash flow.

- Increases in oil & natural gas prices over time, which themselves act as a hedge against inflation.

- Improvements in drilling and extraction technologies over time which can result in increased production from existing wells, better production rates from new wells drilled in the future, and viability of new drilling locations.

Expected and unexpected additional cash flow can manifest from mineral interests in many ways, including:

- Lease bonuses associated with presently unleased acreage owned by the tokenized entity.

- Increases in oil & natural gas prices over time, which themselves act as a hedge against inflation.

- Improvements in drilling and extraction technologies over time which can result in increased production from existing wells, better production rates from new wells drilled in the future, and viability of new drilling locations.

Expected and unexpected additional cash flow can manifest from mineral interests in many ways, including:

- Lease bonuses associated with presently unleased acreage owned by the tokenized entity.

- The drilling of additional wells on entity-owned acreage in the future, increasing cash flow.

- Increases in oil & natural gas prices over time, which themselves act as a hedge against inflation.

Expected and unexpected additional cash flow can manifest from mineral interests in many ways, including:

- The drilling of additional wells on entity-owned acreage in the future, increasing cash flow.

- Increases in oil & natural gas prices over time, which themselves act as a hedge against inflation.

- Improvements in drilling and extraction technologies over time which can result in increased production from existing wells, better production rates from new wells drilled in the future, and viability of new drilling locations.

Expected and unexpected additional cash flow can manifest from mineral interests in many ways, including:

- Lease bonuses associated with presently unleased acreage owned by the tokenized entity.

- Increases in oil & natural gas prices over time, which themselves act as a hedge against inflation.

- Improvements in drilling and extraction technologies over time which can result in increased production from existing wells, better production rates from new wells drilled in the future, and viability of new drilling locations.

Our Flagship Token

Every token you own signifies a stake in our real estate assets. Simply buy and hold to start earning passive income from our cash-flow properties

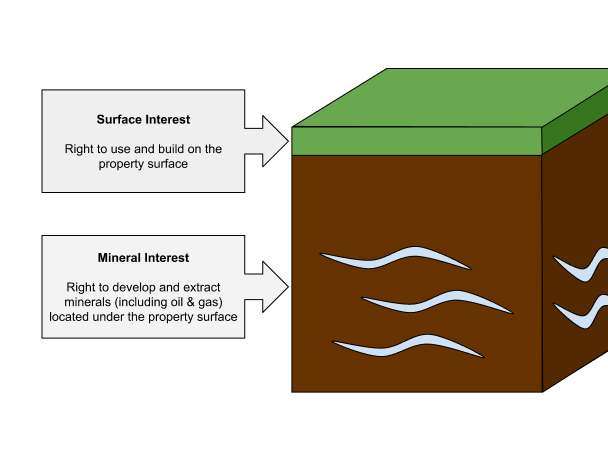

Understanding how mineral rights work in Texas

Mineral rights are a complex and important aspect of property ownership in Texas. They refer to the ownership and rights to extract minerals...

Ownership of Mineral Rights: How do I know who owns the rights?

If you are a property owner in an area that has precious resources like oil, gas, or minerals, you may consider the immediate revenue that your land can provide...

Selling mineral rights is much more different than selling most items.

It goes further than having someone pay for the item and transferring the title of ownership. When you sell your mineral rights, you are transferring all your...